The main benefits of using no credit check fix and flip loans in real estate flipping

Explore the Advantages of No Credit Inspect Fix and Flip Lendings for Your Following Residential Property Task

No credit scores check fix and flip finances supply a special advantage for residential or commercial property investors. They supply fast accessibility to resources without the constraints of conventional credit scores assessments. This financing choice allows financiers to focus on the prospective value of buildings instead than their credit report. As the real estate market progresses, understanding these loans may unlock brand-new avenues for investment (no credit check fix and flip loans). What effects could this have for both skilled and newbie financiers?

Understanding No Credit Rating Inspect Deal With and Flip Finances

While traditional financing frequently rests on credit rating, no credit scores check solution and flip financings offer an option for capitalists looking for to capitalize on genuine estate opportunities. These finances are specifically developed for those who mean to purchase, renovate, and rapidly resell residential properties commercial. By bypassing the credit report rating analysis, loan providers concentrate instead on the residential or commercial property's possible worth and the financier's capability to carry out the job effectively.

This financing choice interest both experienced and beginner financiers who may have less-than-perfect credit history backgrounds or who like to avoid prolonged authorization procedures. Funds from no credit history check fundings can cover procurement prices, renovation costs, and other linked fees, enabling capitalists to act quickly in open markets. Recognizing these fundings enables investors to check out brand-new methods for funding their jobs, ultimately expanding their financial approaches in the vibrant actual estate landscape.

Rate and Performance in Getting Financing

Protecting financing via no debt check solution and flip loans is often a swift and streamlined procedure, allowing capitalists to take possibilities without the hold-ups connected with traditional loaning. Unlike conventional fundings that call for comprehensive credit rating analyses, these fundings concentrate largely on the potential worth of the residential or commercial property and the consumer's investment technique. This efficiency can dramatically reduce the time in between determining a building and obtaining essential funds, allowing investors to act quickly in open markets.

Furthermore, the application procedure is commonly much less cumbersome, often calling for very little documentation. Investors can anticipate much faster authorization times, which is important for those seeking to maximize desirable market problems. no credit check fix and flip loans. Quick access to capital not just enhances a capitalist's ability to shut bargains quickly however likewise assists in implementing improvement plans without monetary hindrances. Generally, the speed and performance provided by no debt check repair and flip car loans encourage investors to optimize their potential returns

Greater Versatility for Investors

No credit score check repair and flip loans offer capitalists better versatility in their financing choices, enabling them to tailor their strategies to details project requirements without the restraints of traditional lending needs. This versatility allows investors to promptly change their financing terms, such as lending quantities and payment routines, according to the one-of-a-kind needs of each building they go after.

These financings usually permit for a range of building types, permitting investors to expand their profiles without being restricted by stringent credit history examinations. This versatility can result in even more ingenious financial investment approaches, as capitalists are encouraged to check out chances that might have been considered too risky under traditional financing approaches.

Inevitably, higher adaptability in financing choices not just enhances an investor's capability to exploit on market trends but likewise cultivates a more vibrant technique to realty financial investment, thrusting possible productivity and development.

Reduced Barriers to Entrance in Realty

Lower obstacles to entrance in realty make it more easily accessible for a wider series of capitalists. Traditionally, getting in the actual estate market called for considerable capital, excellent credit history, and prolonged authorization procedures. No credit rating check solution and flip fundings have revolutionized this landscape. By getting rid of the demand for credit rating assessments, these financings allow aspiring financiers, including those with limited financial histories, to accessibility funds for home jobs. This inclusivity motivates diverse involvement, cultivating innovation and imagination within the market. As an outcome, prospective capitalists can concentrate on their task's feasibility as opposed to their creditworthiness. With fewer economic challenges, individuals can take possibilities that may have previously seemed unattainable. This change not just boosts the economic situation yet additionally adds to rejuvenating areas via property advancement. Ultimately, reduced obstacles to entrance empower a more comprehensive range of financiers to engage this link proactively in genuine estate ventures.

Making Best Use Of Earnings Possible With Quick Renovations

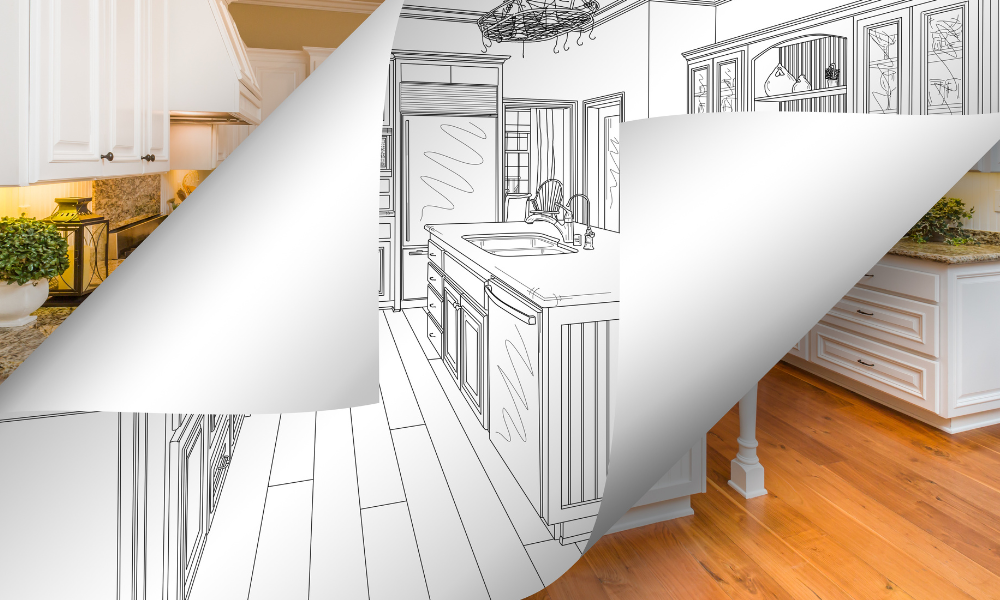

While lots of capitalists acknowledge the importance of timing in the property market, maximizing earnings potential with quick improvements is essential for a successful fix and flip strategy. Quick renovations can significantly raise residential or commercial property value, allowing capitalists to profit from market demand. By concentrating on high-impact areas such as bathroom and kitchens, investors can create a more enticing room without extensive improvements.

Utilizing cost-efficient products and efficient labor can better improve earnings margins, making sure that tasks stay within budget. Furthermore, prioritizing cosmetic upgrades over structural changes decreases downtime, allowing capitalists to listing residential properties quickly.

Frequently Asked Inquiries

What Is the Common Rate Of Interest for No Credit History Examine Fundings?

Common rates of interest for no credit score check lendings vary from 8% to 15%, depending upon the lender and customer's scenario. These rates can be greater than conventional lendings as a result of increased danger for lenders.

For how long Does the Application Refine Usually Take?

The application process for no credit score check lendings typically takes anywhere from a few hours to a number of days. Variables such as documents and lender responsiveness can affect the overall timeline for approval.

Exist Any Kind Of Covert Costs Related To These Fundings?

Yes, there can be concealed costs related to no credit history check financings. Customers must assess car loan agreements meticulously, as costs for processing, origination, and early settlement might not always be plainly divulged upfront.

Can I Make Use Of These Car Loans for Quality Outdoors My State?

Yes, consumers can frequently use no credit check solution and flip financings for homes situated outside their state. It is essential to confirm details loan provider needs and regional guidelines prior to continuing with the financial investment.

What Takes place if I Default on the Funding?

If a debtor defaults on the financing, the lender might initiate foreclosure procedures on the residential property, potentially causing the loss of the financial investment. This can severely damage the borrower's financial standing and future loaning chances.