Hard Money Atlanta Fundamentals Explained

4 Simple Techniques For Hard Money Atlanta

Table of ContentsNot known Incorrect Statements About Hard Money Atlanta Hard Money Atlanta Can Be Fun For AnyoneExamine This Report on Hard Money AtlantaExamine This Report on Hard Money AtlantaSome Known Questions About Hard Money Atlanta.Hard Money Atlanta Things To Know Before You Buy

A difficult cash finance is merely a temporary financing protected by realty. They are funded by (or a fund of capitalists) instead of traditional lending institutions such as banks or lending institution. The terms are typically around year, however the car loan term can be included longer regards to 2-5 years.The quantity the tough cash lenders are able to lend to the customer is primarily based on the worth of the subject home. The residential property may be one the customer currently has and also wishes to utilize as collateral or it may be the residential property the consumer is getting. Tough money loan providers are primarily worried with the instead of the borrower's credit report (although credit scores is still of some value to the lending institution).

When the banks claim "No", the hard cash lenders can still say "Yes". A consumer can obtain a difficult cash finance on nearly any kind of building including single-family residential, multi-family domestic, commercial, land, and also industrial. Some hard cash lending institutions might concentrate on one specific building type such as property and not have the ability to do land financings, just because they have no experience around.

Some Known Facts About Hard Money Atlanta.

Hard money loans are ideal for scenarios such as: Land Loans Building Loans When the Purchaser has credit concerns. When a genuine estate financier needs to act promptly. Investor select to utilize difficult money for various reasons. The main reason is the capability of the tough money loan provider to fund the financing rapidly.

Compare that to the 30 45 days it takes to obtain a financial institution finance funded. The application process for a hard money funding usually takes a day or two and also in some situations, a financing can be authorized the same day.

More About Hard Money Atlanta

Tough money lenders in The golden state usually have reduced rates than other components of the nation since California has numerous hard money providing companies. Increased competitors leads to a decrease in costs.

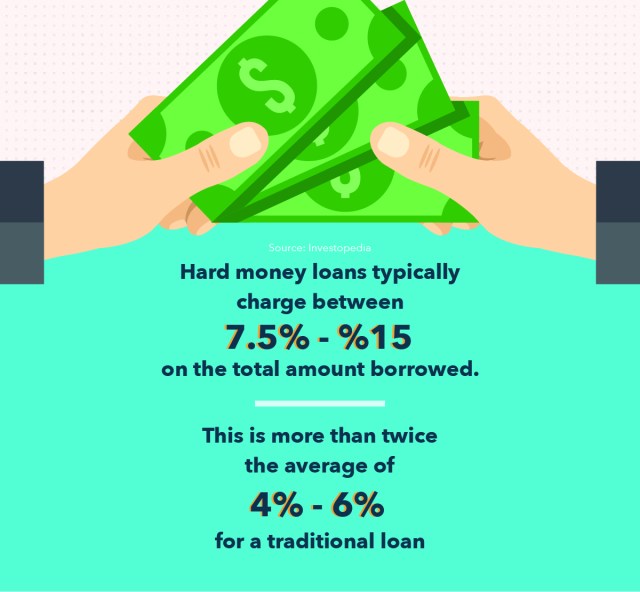

Because of this higher threat included on a hard cash funding, the rate of interest prices for a difficult cash car loan will certainly be more than standard fundings. Rate of interest for tough money finances vary from 10 15% depending on the particular lending institution as well as the perceived threat of the car loan. Factors can vary anywhere from read what he said 2 4% of the total quantity lent.

The lending amount the difficult cash loan provider is able to lend is figured out by the proportion of the car loan quantity separated by the worth of a building. This is called the finance to worth (LTV). Many hard money loan providers will certainly offer approximately 65 75% of the present value of the residential or commercial property.

7 Simple Techniques For Hard Money Atlanta

This creates a riskier car loan from the tough cash lender's perspective because the amount of capital put in by the lender rises as well as the amount of resources spent by the debtor reduces. This increased risk will create a difficult money lender to charge a greater rate of interest - hard money atlanta. There are some tough cash loan providers who will certainly provide a high portion of the ARV as well as will certainly also finance the rehabilitation expenses.

Expect 15 18% interest and 5 6 points when a loan provider funds a finance with little to no down repayment from the borrower (hard money atlanta). In some cases, it might be beneficial for the borrower to pay these excessively high rates in order to secure the bargain if they can still produce make money from the job.

They are much less worried about the consumer's credit score rating. Concerns on a customer's document such as a foreclosure or brief sale can be overlooked if the borrower has the capital to pay the passion on the car loan. The tough cash loan provider have to likewise take into consideration the customer's strategy for the residential property.

Not known Details About Hard Money Atlanta

An additional means to discover a hard cash lending institution is by attending your regional real estate financier club conference. These club meetings exist in most cities as well as are typically well-attended by difficult money lenders aiming to network with possible customers. If no difficult money loan providers exist at the meeting, ask various other investor if they have a difficult cash lending institution they can suggest.

When you need funding quickly yet don't have the ideal credit, you can still obtain the financing you require have a peek at this site offered you obtain the best loan. When it pertains to realty, typical mortgages are not your only choice. You can likewise count on supposed "tough money financings." Exactly how do hard money financings work? Is a difficult money finance suitable for your situation? Today, we'll respond to these questions, providing you the failure of hard money finances.

Rumored Buzz on Hard Money Atlanta

With standard car loan choices, the loan provider, such as a bank or cooperative credit union, will certainly consider your credit rating and also validate your earnings to establish whether you can settle the lending. In contrast, with a tough money funding, you borrow cash from a personal loan provider or private, and their choice to provide will certainly concentrate on the high quality of the possession.